Across the United States, a growing number of workers are finding themselves caught in a frustrating economic bind where the cost of basic necessities like groceries, rent, and gas continues to climb, while their wages remain stubbornly stagnant, failing to match the relentless pace of inflation. This disparity has created a pervasive sense of financial insecurity, pushing many households to the brink as they struggle to afford even the essentials. Reports from leading research organizations paint a grim picture, with data showing that a vast majority of employees feel their earnings are insufficient to cover rising expenses. This economic strain is not just a personal burden but a systemic issue, affecting productivity, mental health, and long-term financial stability. As policymakers and employers grapple with solutions, the urgency to address this widening gap between income and living costs has never been more apparent, setting the stage for a deeper exploration of the challenges and potential pathways forward.

Economic Hardship Hits American Workers

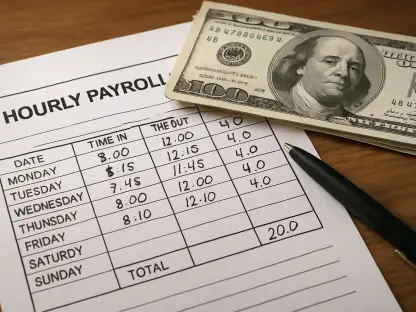

The financial hardship faced by American workers has reached alarming levels, with recent studies revealing a stark mismatch between earnings and the escalating cost of living. A comprehensive report from a prominent think tank highlights that many employees are unable to cover basic needs such as rent and food with their current paychecks, leading to heightened stress and anxiety. The data is striking: over 90% of surveyed workers express concern that their wages are not keeping up with inflation, particularly as the price of groceries emerges as a primary burden. This struggle is compounded by the fact that only a small fraction of these individuals have received raises sufficient to offset the increased expenses. For countless families, this means making tough choices between paying bills and putting food on the table, a situation that underscores the depth of the economic crisis gripping the workforce today.

Beyond the immediate inability to afford necessities, the ripple effects of this wage stagnation are reshaping how workers manage their finances and plan for the future. Many are forced to delay significant life decisions, such as buying a home or starting a family, while others accumulate debt just to maintain a basic standard of living. Retirement savings, once a cornerstone of financial security, are being sacrificed as more income is diverted to cover day-to-day costs. Surveys also indicate a growing trend of employees seeking higher-paying jobs out of necessity, even if it means leaving familiar roles or industries. This pervasive financial pressure not only impacts individual households but also signals potential challenges for businesses, as a workforce under constant strain may struggle with focus and engagement, ultimately affecting overall economic productivity.

Workplace Impacts and Employer Challenges

The growing divide between wages and living costs is taking a noticeable toll on workplace dynamics, with financial stress seeping into employees’ professional lives. Research shows that workers grappling with economic insecurity often experience lower productivity and higher rates of burnout, creating a challenging environment for both staff and management. When employees are preoccupied with how to pay their bills, their ability to concentrate on tasks diminishes, leading to errors and inefficiencies. Moreover, the emotional weight of financial uncertainty contributes to mental health struggles, further exacerbating workplace tension. For employers, this presents a dual problem: maintaining a motivated team while facing the risk of losing talent to competitors who offer better compensation. Addressing these concerns requires more than superficial fixes; it demands a reevaluation of how pay structures align with the realities of today’s economy.

Employers are increasingly finding themselves at a crossroads as the pressure mounts to adapt to the needs of a financially burdened workforce. Failing to offer competitive wages or additional support mechanisms can result in high turnover, which is costly in terms of both time and resources. Some companies have begun exploring options like flexible benefits or wellness programs to alleviate employee stress, but these measures often fall short of addressing the core issue of insufficient income. The broader implication is clear: businesses that do not prioritize fair compensation risk not only diminished performance but also reputational damage in an era where workers are vocal about their struggles. As the labor market tightens, the onus is on employers to innovate and ensure that their pay practices reflect the economic challenges their employees face, fostering loyalty and sustaining operational success.

Policy Proposals and Systemic Solutions

Amid the mounting economic challenges, experts and researchers are advocating for robust policy interventions to bridge the gap left by stagnant wages and soaring living costs. Proposals from influential organizations suggest a multifaceted approach, including the elimination of subminimum wage practices and the enforcement of stronger workers’ rights protections. Additional measures like pay transparency laws and bans on salary history inquiries aim to promote equity in compensation, while expanded training partnerships seek to equip workers with skills for higher-paying roles. These initiatives are designed to hold corporations accountable for low-wage jobs while providing systemic support to those struggling to make ends meet. The emphasis here is on creating a framework where state-level actions can drive meaningful change, recognizing that individual employer adjustments alone cannot address the scale of the current crisis.

The urgency for systemic solutions is further highlighted by the overwhelming demand for basic assistance, as seen in dramatic increases in food bank usage across the country. This surge, partly tied to temporary disruptions in federal aid programs, reflects a deeper, ongoing need for support among low-income households. Beyond immediate relief, policymakers are urged to focus on long-term strategies that tackle the root causes of economic disparity, such as wage stagnation and inadequate safety nets. By implementing “next-generation” pro-worker policies, states can pave the way for a more equitable economy, ensuring that the benefits of growth are shared more broadly. This approach not only addresses the immediate hardships faced by workers but also lays the groundwork for sustainable financial stability, preventing future generations from falling into the same cycle of economic insecurity.

Reflecting on Paths to Economic Balance

Looking back, the persistent mismatch between rising living costs and stagnant wages revealed a critical flaw in the economic landscape, leaving countless American workers in a state of financial vulnerability. The strain manifested in delayed dreams, mounting debt, and diminished workplace morale, while employers wrestled with the consequences of an overburdened workforce. Yet, amidst these challenges, a consensus emerged that actionable steps were essential to restore balance. Policymakers were urged to champion reforms that prioritized fair pay and robust support systems, while businesses were encouraged to rethink compensation strategies to retain talent and boost productivity. Moving forward, the focus shifted to collaborative efforts—between state initiatives and corporate responsibility—to ensure that economic growth translated into tangible benefits for all. By addressing these systemic issues head-on, there was hope that the foundation for a more equitable future had been laid, offering workers a chance to thrive rather than merely survive.