In a world where payroll systems and administrative oversight are often assumed to be foolproof, staggering errors by employers can sometimes result in unexpected financial gains for employees, raising complex questions about accountability and legality. These rare but impactful mistakes, often rooted in human error or systemic flaws, can transform ordinary individuals into beneficiaries of significant sums, while employers scramble to rectify the situation through legal or procedural means. Two distinct cases from different corners of the globe illustrate this phenomenon vividly: a staggering overpayment in Chile that sparked a prolonged legal battle, and a prolonged oversight in Germany that allowed a teacher to receive full pay for over a decade without working. These stories not only highlight the potential for massive financial windfalls but also expose the intricate balance between individual actions and institutional responsibility when such errors occur.

Unpacking Global Cases of Financial Oversights

A Payroll Blunder in Chile with Legal Ramifications

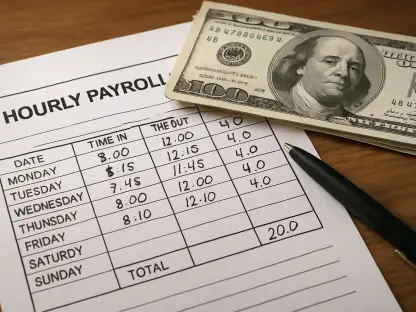

In a striking incident from Chile, a worker at Consorcio Industrial de Alimentos de Chile received an erroneous salary payment of 165 million Chilean pesos, equivalent to roughly $171,600, instead of the expected 500,000 pesos, or about $520, in May of a past year. The company quickly identified the mistake and requested the return of the funds, asserting that the employee had agreed to comply during a meeting with human resources. However, just three days later, the individual resigned and retained the money, prompting the employer to initiate legal action on charges of theft, which carried potential penalties of significant fines and up to 540 days in jail. This case underscores the immediate tension that arises when substantial overpayments occur, as employers seek to recover funds while navigating the boundaries of legal recourse and employee rights in the aftermath of such an error.

The legal battle that ensued lasted three years, culminating in a ruling by judges in Santiago in September of a recent year, where the case was dismissed on the grounds that the incident qualified as an “unauthorized collection” rather than theft, thereby shielding the employee from prosecution. Despite this outcome, the company expressed dissatisfaction with the verdict and announced intentions to appeal, signaling an ongoing effort to reclaim the substantial sum. This resolution highlights a nuanced interpretation of responsibility, where the judiciary distinguished between intentional wrongdoing and the mere act of retaining mistakenly disbursed funds. It also raises broader questions about the mechanisms employers must have in place to prevent such errors and the challenges they face in recovering losses when legal systems prioritize intent over outcome in financial disputes.

A Prolonged Oversight in German Education

Turning to Germany, a teacher in North Rhine-Westphalia benefited from an extraordinary administrative lapse, receiving a full annual salary of approximately $48,000 for 16 years while on sick leave due to chronic illness and psychological issues, starting over a decade ago. This situation went unnoticed until a change in school management triggered an internal review in a recent year, finally uncovering the prolonged absence. Despite policies mandating a medical assessment after three months of leave, no such evaluation was enforced, and extensions were repeatedly granted without scrutiny. This case reveals a glaring failure in institutional oversight, where systemic neglect allowed a significant financial oversight to persist for years, undetected by those responsible for monitoring employee status.

The revelation prompted shock from the education minister of the region, who publicly addressed the lapse, while a health examination was scheduled to assess the teacher’s current condition. This incident sheds light on the vulnerabilities within large administrative systems, particularly in public sectors like education, where oversight can falter amid bureaucratic complexities. Unlike the Chilean case, where individual action played a role in retaining funds, the German teacher’s windfall appears to stem from passive circumstances rather than deliberate intent, pointing to a different facet of accountability. It emphasizes the need for robust checks and balances to prevent such prolonged errors, as well as the potential embarrassment and financial strain employers face when systemic failures are exposed after such an extended period.

Exploring Themes of Accountability and Systemic Flaws

Individual Actions versus Employer Responsibility

When financial windfalls result from employer errors, the line between individual accountability and organizational responsibility often blurs, creating a complex web of ethical and legal considerations. In the Chilean scenario, the employee’s decision to retain the overpaid sum after resignation fueled a narrative of potential opportunism, yet the court’s ruling suggested that the burden of error lay primarily with the employer for the initial mistake. This perspective challenges the notion that individuals must always bear the consequences of benefiting from errors, instead placing emphasis on the employer’s duty to implement safeguards against such mishaps. The interplay between personal choice and systemic failure becomes a critical point of analysis in understanding how these windfalls occur and are resolved in varying contexts across different jurisdictions.

Contrastingly, the German teacher’s situation illustrates a lack of individual agency, as the financial gain resulted from administrative negligence rather than active retention of funds. Here, the spotlight falls squarely on the employer’s failure to monitor and enforce policies, highlighting how institutional lapses can inadvertently create windfalls without any intent from the recipient. This disparity between the two cases reveals a spectrum of responsibility, where outcomes depend on both the actions of the individual and the robustness of the systems in place. Employers must grapple with not only recovering losses but also addressing internal weaknesses that allow such errors to persist, whether through payroll discrepancies or unchecked leave policies, to prevent future financial oversights of this magnitude.

Lessons Learned from Rare Financial Mishaps

Reflecting on these extraordinary cases, it becomes evident that employer errors can lead to significant financial gains for employees, often with outcomes shaped by legal interpretations and administrative shortcomings. The Chilean worker managed to retain a massive overpayment after a court dismissed theft charges, though the employer’s persistent appeals indicated an unresolved struggle. Meanwhile, the German teacher’s 16-year paid absence, uncovered only recently, exposed profound systemic lapses that had gone unchecked for far too long. These incidents serve as stark reminders of the vulnerabilities in payroll and management systems, urging a reevaluation of oversight mechanisms.

Looking ahead, employers should prioritize implementing stringent checks to prevent payroll errors and ensure regular audits of employee status to avoid prolonged oversights. Investing in technology for accurate financial transactions and establishing clear protocols for leave management could mitigate such risks. Additionally, legal frameworks might need refinement to address the gray areas of unauthorized collections versus theft, providing clearer guidance for both parties. By learning from these rare yet impactful cases, organizations can better safeguard against financial windfalls while fostering accountability at both individual and systemic levels for a more resilient operational future.