As the holiday season approaches in 2025, the retail industry stands at a crossroads, grappling with unprecedented economic challenges that are reshaping hiring practices for this critical sales period, while retailers face a turbulent labor market, declining consumer confidence, and persistent inflationary pressures that have tightened budgets for both businesses and shoppers. Holiday sales forecasts paint a grim picture, with predictions of flat growth or even a decline, forcing companies to rethink the traditional approach of ramping up seasonal staffing. This shift raises pressing questions about how retailers will balance the need for adequate manpower during the busiest shopping time of the year against the risk of overextending resources in a weak economic environment. The strategies adopted now could redefine customer experiences and set a precedent for future holiday seasons. This exploration delves into the driving forces behind these hiring trends and their broader implications for the retail landscape.

Economic Challenges Impacting Seasonal Staffing

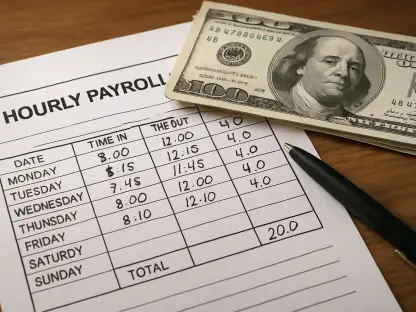

The economic climate in 2025 has cast a significant shadow over retail hiring plans for the holiday season, with stark data reflecting the depth of the challenge. According to Challenger, Gray & Christmas, job cuts in the retail sector surged by an alarming 274% in the first five months of this year compared to the same period in 2024. This wave of layoffs, coupled with a sluggish broader labor market, has eroded consumer confidence, particularly among lower-income households struggling to afford basic necessities. Holiday sales projections remain bleak, with expectations of either stagnant growth or a downturn, prompting retailers to adopt a cautious stance. The forecast for seasonal hiring is equally concerning, with estimates suggesting fewer than 500,000 temporary workers will be brought on board—a potential low not seen since the recession of 2009. This conservative approach signals a profound shift in how retailers are navigating economic uncertainty.

Beyond the raw numbers, additional pressures are compounding the hiring downturn and reshaping retail strategies. Looming tariffs and persistent inflation continue to squeeze profit margins, while a growing reliance on automation reduces the need for large temporary workforces. Many retailers have chosen not to disclose specific hiring targets, reflecting a mindset of minimizing risk in an unpredictable sales environment. As noted by industry experts, this “do more with less” philosophy is becoming a hallmark of the season, with companies bracing for leaner operations. While a late surge in hiring remains a possibility if holiday sales exceed expectations, the current pace of announcements suggests that most retailers are not banking on a significant uptick. This cautious outlook could have ripple effects, influencing everything from store operations to customer service quality during peak shopping periods.

Adapting Workforce Strategies for Efficiency

In response to these economic constraints, retailers are pivoting away from traditional large-scale seasonal hiring and embracing more flexible workforce management tactics. A notable trend is the focus on leveraging existing employees by offering additional hours rather than recruiting vast numbers of temporary staff. On-demand teams are also being utilized to fill gaps during high-traffic periods, allowing companies to scale labor needs without long-term commitments. This approach not only curbs costs but also aligns with a broader push for operational efficiency amid uncertain consumer spending patterns. By prioritizing internal resources, retailers aim to maintain agility, ensuring they can adapt quickly if sales forecasts shift unexpectedly. This strategic recalibration reflects a deeper transformation in how holiday demand is managed in a challenging economic landscape.

To attract the limited seasonal talent still required, retailers are enhancing their offerings with a range of incentives designed to stand out in a competitive labor market. Flexible scheduling options, employee discounts, and competitive wage packages are becoming standard tools to draw in workers for short-term roles. These perks acknowledge the vital role seasonal associates play in delivering exceptional customer service during the holiday rush, even as overall hiring numbers decline. Moreover, some companies are emphasizing potential career paths to convert temporary hires into permanent staff, adding an extra layer of appeal. This focus on quality over quantity in staffing efforts suggests that retailers are not only cutting back but also rethinking how to maximize the impact of every hire. Such adaptations could redefine seasonal employment dynamics, prioritizing worker satisfaction alongside business needs.

Varied Hiring Approaches Across Retail Sectors

Retailers are not adopting a one-size-fits-all strategy when it comes to holiday hiring in 2025; instead, approaches differ widely based on market positioning and seasonal demand expectations. Specialty retailers with niche focuses are often taking a more aggressive stance. For instance, Spirit Halloween is planning to hire around 50,000 workers to support over 1,500 locations, capitalizing on the high anticipation for Halloween-related sales. Similarly, Bath & Body Works is targeting more than 30,000 seasonal associates across North America, maintaining a hiring level consistent with previous years. These companies view robust staffing as essential to meeting customer expectations during peak demand, showcasing confidence in specific holiday markets despite broader economic concerns. Their strategies highlight how targeted demand can drive hiring decisions even in a restrained environment.

In stark contrast, mass retailers are exhibiting greater caution, reflecting broader uncertainties in consumer behavior across diverse product categories. Target, for example, has refrained from announcing a specific hiring goal this year, opting instead to focus on providing extra hours to current employees and utilizing its substantial on-demand team. While applications for store and supply chain roles are still being accepted, the lack of a concrete target signals a wait-and-see approach to holiday sales performance. Other large chains like Kohl’s have also avoided nationwide hiring figures, though localized efforts in specific regions are underway. This divergence in strategy across retail segments underscores the uneven impact of economic conditions, with some players betting on seasonal spikes while others hedge against potential downturns. The resulting patchwork of hiring plans paints a complex picture of an industry in flux.

Navigating the Future of Holiday Retail Staffing

Reflecting on the holiday season of 2025, it becomes evident that retailers navigated a landscape marked by restraint and adaptation, with seasonal hiring dropping to under 500,000—the lowest since 2009. Economic challenges like inflation and declining consumer spending forced a reevaluation of staffing models, leading many to prioritize existing workforces and automation over traditional temporary hires. The diversity in approach, from aggressive recruitment by niche retailers to cautious strategies by mass merchants, highlighted the varied pressures within the sector. Moving forward, retailers should consider investing in technology to streamline operations further while maintaining a focus on employee incentives to attract talent in tight labor markets. Building flexible staffing frameworks will be key to handling future holiday demands without overextending resources. These steps could ensure resilience, setting a sustainable path for balancing customer expectations with economic realities in the years ahead.