As the calendar edges closer to January 1, 2026, Minnesota stands on the brink of a groundbreaking shift in worker benefits with the introduction of a state-run Paid Family and Medical Leave program. This initiative, rooted in a key 2023 policy from the DFL-led government, promises to deliver paid time off for employees navigating serious health challenges, welcoming a new child, or managing critical family needs. It represents a bold move toward ensuring that every worker in the state has access to essential support during life’s most demanding moments, aligning Minnesota with a growing national focus on work-life balance.

This new law is poised to reshape the landscape for both employees and employers across the state. For workers, it offers a vital safety net with up to 12 weeks of paid leave, while businesses must adapt to new administrative and financial responsibilities. Meanwhile, state officials are working diligently to ensure a smooth rollout. With significant implications for the workforce and potential political ripples in the 2026 elections, the program’s launch is a pivotal moment for Minnesota’s social and economic fabric.

Understanding the New Paid Leave Program

Program Benefits and Planning

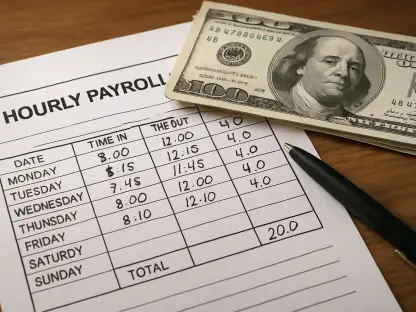

The forthcoming paid leave program in Minnesota is designed to provide substantial relief to workers, offering up to 12 weeks of paid time off for qualifying events such as bonding with a newborn or addressing serious personal or family medical issues. Benefits are calculated based on individual income, ensuring a tailored approach to support. State officials have rolled out practical tools like online calculators to help employees estimate their potential benefits, making it easier to understand what to expect. This transparency is crucial for those anticipating major life events in 2026, as it allows for informed financial and personal planning well in advance of the program’s start date.

Beyond just numbers, the emphasis on proactive planning cannot be overstated. Employees are strongly encouraged to initiate early conversations with their employers to coordinate leave schedules and avoid potential disruptions. Such discussions help clarify expectations on both sides, ensuring that the transition into taking leave is seamless. State guidance highlights that aligning personal needs with workplace policies is key to maximizing the program’s value, especially for those with predictable events like childbirth. This preparation is not merely a suggestion but a vital step in navigating the new system effectively.

Scope and Scale of Impact

The scale of Minnesota’s paid leave initiative is ambitious, with the state targeting to serve between 10,000 and 12,000 workers monthly once the program is fully operational. This figure underscores the significant reach of the policy, comparable in scope to the state’s unemployment insurance system, and reflects the anticipated demand for such benefits. Administered by the Department of Employment and Economic Development (DEED), the program prioritizes efficiency, aiming to process leave applications within a tight two-week window. This goal hinges on timely cooperation from all involved parties, particularly employers, to maintain a streamlined operation.

A critical component of this efficiency is the seven-day verification window for employers to confirm leave applications submitted by their employees. This short timeframe is intended to prevent delays and keep the process moving swiftly, ensuring workers receive benefits without unnecessary waiting periods. State leaders have stressed that clear communication between employees and employers during this verification stage is essential. By fostering collaboration, the program seeks to minimize bottlenecks and deliver on its promise of accessible, prompt support for Minnesota’s workforce during critical times.

Employer Responsibilities and Challenges

Administrative and Financial Decisions

As the launch of Minnesota’s paid leave program approaches, businesses across the state are tasked with significant preparatory steps to comply with the new law. Employers must appoint leave administrators to serve as the primary point of contact with the state’s Paid Leave office, ensuring smooth handling of applications and inquiries. Additionally, companies face the decision of whether to enhance benefits beyond the state-mandated minimum, a choice that could influence their ability to attract and retain talent. These administrative responsibilities require careful planning to integrate the new requirements into existing human resources frameworks without disrupting operations.

Financially, the program introduces a payroll tax of just under 1%, set to begin in April 2026, to fund the leave benefits. Employers have the flexibility to decide whether to cover the full cost of this tax or share it with their employees, a decision that carries implications for both budgets and employee relations. For many businesses, particularly small and medium-sized enterprises, this added expense demands a strategic reassessment of financial priorities. Balancing compliance with fiscal sustainability is a pressing concern as companies navigate the transition, with some already exploring ways to offset costs while maintaining competitive compensation packages.

Resistance and Support Among Businesses

While the paid leave program offers clear benefits for workers, employer reactions across Minnesota remain mixed, reflecting a spectrum of enthusiasm and concern. Some businesses, particularly those without existing leave policies, view the state mandate as a baseline that allows them to build more generous offerings as a competitive edge in the labor market. This perspective sees the program as an opportunity to enhance employee satisfaction and loyalty by supplementing state benefits with additional perks or extended leave periods. For these employers, the new law is a catalyst for reevaluating how they support their workforce in a holistic manner.

Conversely, resistance persists among other segments of the business community, especially larger corporations that already provide private leave plans. Many of these employers argue that the state program introduces redundant costs and administrative burdens, particularly through the payroll tax and mandatory compliance measures. Recent events, such as discussions at the Minnesota Chamber of Commerce conference, have revealed lingering apprehension about the added financial strain and complexity. Despite state efforts to address these concerns through outreach, the divide highlights an ongoing tension between mandated benefits and private sector autonomy, a debate likely to continue as the rollout nears.

State Efforts and National Context

Implementation and Outreach Initiatives

The state of Minnesota, through DEED, is spearheading the implementation of the paid leave program with a framework modeled after the existing unemployment insurance system, aiming for operational clarity and efficiency. Leaders such as Greg Norfleet, director of the Paid Leave program, and Evan Rowe, DEED Deputy Commissioner, have expressed strong confidence in meeting statutory deadlines and delivering a user-friendly experience for all stakeholders. Their optimism is backed by concrete targets, such as processing leave applications within two weeks, provided employers adhere to verification timelines. This structured approach is designed to instill trust in the system’s reliability from day one.

To facilitate a smooth transition, the state has rolled out a comprehensive suite of support resources tailored to both workers and employers. An online portal offers detailed information and tools, while a dedicated call center addresses individual queries. Additionally, numerous workshops are being conducted statewide to educate stakeholders on the program’s intricacies and benefits. These initiatives reflect a proactive effort to bridge knowledge gaps and mitigate confusion, ensuring that businesses and employees alike are well-prepared for the changes ahead. The focus on accessibility through multiple channels underscores the state’s commitment to a successful launch.

Broader Trends in Worker Protections

Minnesota’s paid leave program does not exist in isolation but is part of a broader national movement toward enhancing worker protections through state-led initiatives. By joining 12 other states with similar policies, Minnesota positions itself as a leader in addressing the evolving needs of the modern workforce, particularly in balancing professional and personal responsibilities. This trend reflects a growing recognition of the importance of paid leave as a fundamental component of employee well-being, driven by increasing public demand for policies that support family and medical needs without sacrificing financial stability.

The implications of this movement extend beyond immediate benefits, signaling a shift in how governments and businesses share responsibility for worker support. As more states adopt comparable programs, a patchwork of policies emerges, potentially influencing federal discussions on standardized leave benefits. For Minnesota, being at the forefront of this change offers a chance to set a precedent, though it also comes with the challenge of navigating uncharted territory. The program’s early performance could serve as a benchmark for others, highlighting the state’s role in shaping the future of labor policies across the nation.

Reflecting on a Milestone Achievement

Looking back, the journey to Minnesota’s Paid Family and Medical Leave program, which became a reality through legislative efforts in 2023, marked a historic commitment to worker welfare. The intensive preparations by DEED, coupled with the rollout of extensive resources, demonstrated a resolve to support the state’s workforce during pivotal life events. While employer apprehensions and logistical hurdles were evident, the collaborative spirit fostered through workshops and public outreach laid a strong foundation for the program’s launch on January 1, 2026.

Moving forward, the focus should shift to monitoring the program’s impact and refining its execution based on real-world feedback. Stakeholders are encouraged to engage actively with state resources to address any emerging issues promptly. Additionally, policymakers might consider evaluating the payroll tax structure and benefit levels in the coming years to ensure sustainability and fairness. As Minnesota pioneers this path, its experience could inform national conversations on paid leave, offering valuable lessons on balancing innovation with practical implementation for future policy advancements.