A significant shift is underway in corporate America as chief executives increasingly step into the role of chief storyteller, attempting to build a fortress of information around their organizations to shield employees from the relentless barrage of external speculation. In a calculated effort to

The slow and silent accumulation of workplace injuries presents one of the most persistent challenges in occupational health, where the damage is often done long before the first symptom becomes apparent. For countless workers in physically demanding industries, the true cost of their labor is a

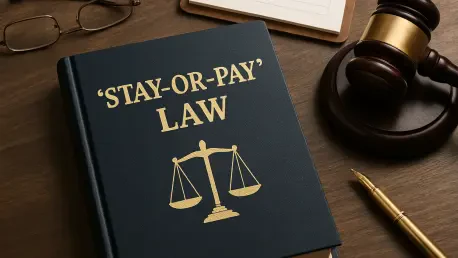

With the New York Legislature's "Trapped at Work Act" creating waves of uncertainty for employers, we turn to Sofia Khaira, a leading expert in diversity, equity, and inclusion, for clarity. The Act, signed into law in December 2025, faced immediate calls for revision, leading to a proposed chapter

With an estimated 150 million workdays lost to illness annually in England, costing businesses an average of £120 in lost profit for each day of absence, a stark new warning highlights that many companies are dangerously unprepared to handle workplace emergencies. Leading first aid charity St John

The legislative activity of 2025 signaled a profound and accelerated evolution in the American workplace, introducing a complex web of new state and local employment laws that reshaped the responsibilities of businesses nationwide. This surge of regulatory change went far beyond minor adjustments,

A landmark decision from the Tennessee Supreme Court has fundamentally redefined the long-standing legal protections that have shielded retailers from personal injury lawsuits brought by the employees of their product vendors. In the pivotal case of Coblentz v. Tractor Supply Co. , the court