In 2025, significant changes to US retirement savings plans will come into effect due to provisions from the SECURE Act 2.0. This federal legislation, aimed at facilitating Americans’ management and contributions to tax-advantaged retirement plans, is set to improve access to these savings vehicles. The SECURE Act 2.0, which was passed in 2022, builds on the original SECURE Act (Setting Every Community Up for Retirement Enhancement Act) from December 2019. While some parts of the SECURE 2.0 Act have already taken effect, the full implementation will roll out incrementally from January 2024 through 2027. These changes are designed to provide more flexibility and support to individuals as they plan for their retirement years.

New Required Minimum Distribution Rules (2023-2033)

One of the central changes introduced by the SECURE Act 2.0 involves required minimum distributions (RMDs), which are obligatory withdrawals from retirement accounts like traditional 401(k)s and IRAs funded with pretax money. The IRS mandates these RMDs to ensure that taxes are eventually paid on the funds invested. The SECURE Act 2.0 introduces several modifications to RMDs aimed at providing more control and flexibility to retirees. For instance, the RMD age increased from 72 to 73 in 2023 and will eventually rise to 75 in 2033. This change allows retirees to keep their money invested for a longer period, potentially increasing their retirement savings through continued growth.

Additionally, as of 2023, the penalty for failing to take an RMD has been reduced from 50% of the required distribution to 25%. If corrective actions are taken promptly, the penalty can be further reduced to 10%. This reduction in penalties is intended to lessen the financial burden on retirees who might miss their RMDs due to oversight or misunderstanding. Another significant change set to take effect in 2024 exempts Roth accounts, including workplace Roth accounts, from RMDs altogether. These adjustments collectively aim to offer retirees more flexibility and reduce the punitive nature of RMD-related penalties, ultimately giving them more control over their retirement funds and tax planning strategies.

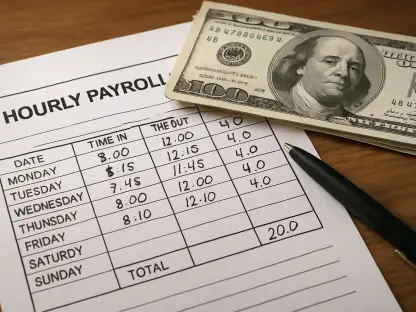

Financial Incentives for 401(k) Contributions (2023)

One notable provision of the SECURE Act 2.0 is the introduction of financial incentives to encourage employees to contribute to 401(k) retirement savings plans. Specifically, employers are now allowed to offer small financial incentives such as gift cards to encourage employees to save for retirement. This measure, however, comes with specific guidelines from the IRS, ensuring the value of these incentives does not exceed $250 and can only be offered to employees not currently enrolled in the employer’s retirement plan.

This provision aims to boost employee participation in retirement savings programs by recognizing that immediate rewards can motivate some workers to begin contributing. By providing these incentives, employers can help foster a culture of saving and ensure more employees are prepared for retirement. This approach can be particularly effective in reaching individuals who may not have prioritized retirement savings in the past. Through offering these immediate, tangible benefits, the SECURE Act 2.0 is designed to promote proactive retirement planning and increase participation rates among workers.

Relaxed Roth Rules for Employer-Sponsored Accounts (2023)

Another significant change brought by the SECURE Act 2.0 involves Roth retirement accounts, which are known for their tax advantages. Roth accounts require contributions with post-tax money, but distributions in retirement are tax-free, offering significant long-term benefits. Before the Act’s changes, only employee contributions could be directed into a Roth account, while any employer matching contributions had to be placed into a separate pretax account. This created complexity and limited the tax advantages that employees could enjoy.

The SECURE Act 2.0 simplifies this by allowing employers to treat matching contributions as Roth contributions. This means employees can now benefit from tax-free distributions not only on their contributions but also on their employer’s matching contributions. Additionally, the Act permits Roth contributions to SEP (Simplified Employee Pension) and Simple IRAs (Savings Incentive Match Plan for Employees), which was not allowed previously. These changes collectively make it easier for employees to maximize their tax-advantaged retirement savings and align their retirement strategies with personal tax preferences.

Hardship Distribution Rules (2023-2024)

The Act introduces more lenient rules for penalty-free withdrawals from retirement accounts in cases of financial hardship, recognizing the need for flexibility during difficult times. One important provision is the allowance for emergency expense withdrawals, where up to $1,000 can be taken out for specific emergency expenses without penalty, with an option to repay the amount within three years if desired. This helps to provide immediate financial relief without the usual penalties associated with early withdrawals.

Furthermore, the Act permits penalty-free distributions for those diagnosed with a terminal illness and allows individuals affected by domestic violence to withdraw up to $10,000 or 50% of their retirement account balance, whichever is lower. Additionally, up to $22,000 can be withdrawn penalty-free if affected by a federally declared disaster, providing crucial financial support to those in areas experiencing significant hardships. Employers have the discretion to implement these provisions, allowing for greater support and flexibility for workers facing unforeseen financial challenges.

529 to Roth IRA Rollovers (2024)

Parents saving for their child’s education using a 529 plan may face concerns about unused funds once educational expenses are met. To address this, the SECURE Act 2.0 permits rollovers of up to $35,000 from a 529 plan to a Roth IRA for the beneficiary, provided certain conditions are met. This includes adhering to regular Roth IRA annual contribution limits, ensuring the rollover provides a seamless transition of funds without penalties.

This provision offers a practical solution for families looking to repurpose unused educational savings for long-term retirement funds. By allowing these rollovers, the SECURE Act 2.0 provides flexibility and ensures that contributions made for educational purposes can still be utilized advantageously, without the worry of funds being locked away or underutilized.

Student Loan Matches (2024)

Balancing student loan payments with saving for retirement has been a significant challenge for many young professionals. Recognizing this, the SECURE Act 2.0 includes a provision that permits employers to treat student loan payments as retirement contributions for the purpose of employer matching in 401(k), 403(b), government 457(b), or Simple IRA plans. This allows employees to effectively receive retirement contributions from their employer while repaying their student loans.

By acknowledging student loan repayments as a form of retirement contribution, the Act helps ensure that young professionals do not miss out on crucial employer retirement contributions while managing their debt. This step is particularly important for recent graduates who may struggle to allocate funds to both student loan payments and retirement savings. Through this provision, the SECURE Act 2.0 aims to provide a more balanced approach to financial planning, helping young workers build their retirement savings without sacrificing their obligations to student loan repayment.

Changes in Catchup Contributions (2024-2026)

The SECURE Act 2.0 also introduces significant revisions to catchup contributions, providing older employees with the opportunity to bolster their retirement savings in the years approaching retirement. Notably, starting in 2024, catchup contribution limits for IRAs will adjust annually for inflation. This ensures that the contribution limits remain relevant and effective in combating the rising cost of living and inflationary pressures.

Moreover, beginning in 2025, individuals aged between 60 and 63 can contribute up to $10,000 (indexed for inflation) in most employer plans, significantly enhancing their ability to save more aggressively as they near retirement. From 2026 onward, those earning over $145,000 annually will be required to make catchup contributions to a Roth account rather than a traditional pretax account. This change reflects a shift towards encouraging tax planning strategies that can benefit individuals’ long-term financial health, particularly for higher earners. By enhancing the catchup contributions, the SECURE Act 2.0 aims to support older workers in maximizing their retirement savings potential.

Automatic 401(k) Enrollment (2025)

To encourage consistent retirement savings, the SECURE Act 2.0 mandates automatic 401(k) enrollment for employees working at companies with plans established after December 28, 2022. This requirement, effective in 2025, establishes a default contribution rate ranging from 3% to 10% of the employee’s pretax salary. Additionally, an automatic annual escalation until contributions reach 10% to 15% of pay is required, increasing the amount saved each year without necessitating action from employees.

Employees, however, retain the option to opt out or adjust their contribution rate if desired. This automatic enrollment strategy is particularly effective in overcoming inertia that prevents many workers from actively enrolling in retirement plans. It also ensures that employees start saving early in their careers, benefiting from compound interest over time. By mandating this approach, the SECURE Act 2.0 promotes a culture of proactive and sustained retirement savings among the workforce.

New Rules for Old 401(k)s (By End of 2024)

Addressing the problem of forgotten or unclaimed retirement accounts, the SECURE Act 2.0 includes provisions to streamline account management and asset tracking. By December 29, 2024, a searchable database will be created to help workers locate retirement accounts held with previous employers. This initiative aims to simplify the process of tracking and managing multiple retirement accounts over the course of a career.

Additionally, the Act permits employers to transfer former employees’ 401(k) balances below $7,000 into an IRA, raising the previous threshold from $5,000. This simplified transfer process helps ensure that smaller retirement balances are not lost or overlooked. By improving the management of old retirement accounts, the SECURE Act 2.0 seeks to enhance financial planning and ensure that retirees can easily track all their retirement savings.

More 401(k) Access for Part-Time Workers (2025)

The SECURE Act 2.0 extends 401(k) access to a broader segment of the workforce by lowering the threshold for part-time workers’ participation in employer retirement plans. Starting in 2025, employees with at least 500 hours of service over two consecutive years will be eligible to participate in these plans. This provision only applies to plans established from January 1, 2025, onward.

By expanding access to retirement benefits for part-time workers, the Act acknowledges the significant contributions of this portion of the workforce and ensures they have opportunities to save for their retirement. This change is particularly beneficial for those who may not have previously qualified for employer-sponsored retirement plans due to their part-time status, thereby providing greater inclusivity and support in retirement planning.

New Saver’s Match (2027)

In 2025, notable shifts to US retirement savings plans will take place because of provisions from the SECURE Act 2.0. This federal law, which aims to help Americans better manage and contribute to tax-advantaged retirement plans, is intended to improve access to these financial tools. Passed in 2022, the SECURE Act 2.0 expands upon the original SECURE Act (Setting Every Community Up for Retirement Enhancement Act) that was enacted in December 2019.

Although some aspects of the SECURE 2.0 Act have already been put into practice, the complete implementation will occur gradually from January 2024 to 2027. These legislative updates are designed to offer individuals more flexibility and support as they prepare for retirement. The changes include raising the age for required minimum distributions, enhancing catch-up contribution limits for older workers, and offering new incentives for small businesses to establish retirement savings plans for their employees.

Overall, the adjustments stemming from the SECURE Act 2 will significantly reshape how Americans save for retirement, making it easier to grow their nest eggs and secure their financial future. Through these measures, the Act aims to ensure a more stable and prepared retirement phase for a greater number of people.