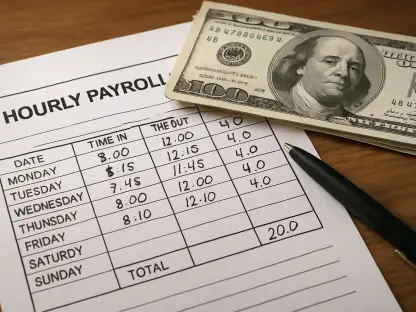

A comfortable retirement, once a cornerstone of the American dream, is increasingly viewed as a monumental financial challenge, pushing worker stress to unprecedented levels. A comprehensive analysis of the nation’s workforce has revealed a startling and growing disparity between retirement aspirations and the stark reality of savings, with nearly half of all American workers (48%) now believing they require at least a $1 million nest egg to retire comfortably. This figure marks a significant jump from previous surveys, which placed the number at 37%. However, the sobering truth is that only a fraction of these individuals, a mere 27%, actually expect to reach this seven-figure milestone. This widening chasm between desire and achievability has become a primary source of anxiety, as a staggering 90% of employees report experiencing financial stress. The main culprits fueling this unease are persistent inflation, which 65% of workers cite as a top concern, followed by the burdens of credit card debt (40%) and escalating housing costs (31%). This confluence of economic pressures is reshaping the landscape of work and retirement planning.

The Psychology of a Widening Divide

Paradoxically, despite the overwhelming financial pressure and the seemingly insurmountable savings goals, a strong undercurrent of long-term optimism persists among the American workforce. A remarkable 71% of workers report feeling at least somewhat confident in their ability to eventually achieve a comfortable retirement. This creates a significant “confidence gap”—a disconnect between employees’ feelings of future security and their present financial struggles and savings trajectory. This optimism, while a positive psychological buffer, can also mask the urgent need for concrete action and planning. The danger lies in confidence that is not backed by a viable financial strategy, potentially leading to delayed or inadequate preparation. As a result, there are growing calls for employers to step into this breach, moving beyond traditional retirement plans to offer more comprehensive financial wellness programs. These initiatives would aim to help employees translate their long-term confidence into tangible, actionable steps, providing the tools and guidance needed to navigate debt, build emergency savings, and create a realistic path toward their retirement goals.

The experience of retirement anxiety and confidence is not uniform across the workforce; instead, it varies dramatically between different generations, each shaped by unique economic circumstances. Gen Z, the youngest cohort in the workforce, surprisingly expresses the most confidence in their retirement prospects, with 88% feeling positive about their long-term financial future. Yet, this optimism is sharply contrasted by their present-day reality, as they also suffer the most from day-to-day financial anxiety, with 73% reporting high levels of stress. On the other end of the spectrum, Gen X, often caught between supporting aging parents and raising children, is the least confident generation regarding their retirement savings, with only 61% feeling secure. Meanwhile, baby boomers, who are nearest to or already in their retirement years, are the most likely to acknowledge the shortfall by considering a postponement of their retirement plans. These distinct generational perspectives highlight the complexity of the retirement crisis, underscoring that a one-size-fits-all solution is insufficient to address the varied challenges faced by workers at different life stages.

Navigating Immediate Pressures and Future Uncertainty

Faced with a widening savings gap and persistent economic headwinds, a majority of American workers are now recalibrating their career timelines, with 54% actively considering delaying retirement. This course of action is not being contemplated equally across genders, as a larger proportion of women (58%) are preparing to work longer compared to men (48%), a disparity that often reflects systemic issues such as pay gaps and career interruptions for caregiving. The decision to postpone retirement is a direct consequence of the immense pressure to catch up on savings in an environment where immediate financial needs often take precedence. For many, working additional years is no longer a choice but a perceived necessity to build a sufficient nest egg. This trend has significant implications for both the individuals, who may face health and well-being challenges from extended careers, and for the broader labor market, which will need to adapt to an older workforce. The dream of a traditional, fixed-age retirement is giving way to a more fluid and often extended working life for a growing segment of the population.

A significant disconnect in perception further complicates the retirement crisis, with employers and employees holding vastly different views on workforce preparedness. Recent findings from a PNC Bank analysis revealed that over three-quarters of employers believe their employees are on track for a secure retirement, a sentiment that starkly contrasts with the reality experienced by their staff. Less than half of the workers themselves share this optimistic view, highlighting a major perception gap that can hinder the effectiveness of workplace benefits and support systems. This disparity suggests that many employers may be unaware of the depth of financial stress their employees are under. Further compounding the issue, a Transamerica Institute study found a broad consensus across all generations that simply working until the traditional retirement age may no longer be sufficient to accumulate the necessary savings. Immediate concerns, such as paying down high-interest debt and building a cushion for emergencies, frequently and necessarily take priority over contributions to long-term retirement accounts, creating a cycle where future security is constantly deferred for present stability.

A Call for Systemic Financial Wellness

The extensive examination of the U.S. retirement landscape ultimately painted a clear picture of a system under strain, where individual anxieties were compounded by systemic disconnects. The conversation shifted from merely acknowledging the savings gap to dissecting its root causes, including the psychological paradox of misplaced confidence and the starkly different realities faced by each generation. The evidence pointed toward a critical need for a fundamental change in how financial security was approached within the workplace. It became apparent that traditional retirement benefits alone were insufficient. The dialogue moved toward advocating for holistic financial wellness programs, which employers were urged to adopt. These programs aimed to address the immediate stressors—debt, budgeting, emergency funds—that prevented employees from focusing on long-term goals. The consensus concluded that resolving the retirement crisis required a proactive, empathetic partnership between employers and employees, one that recognized that a secure future was built upon a stable present.