A peculiar paradox is unfolding across the American workforce, where a pervasive sense of daily financial strain is inexplicably coupled with a resilient optimism about long-term retirement prospects. Despite grappling with record levels of economic anxiety driven by persistent inflation and mounting debt, a significant majority of employees maintain a steady confidence in their ability to achieve a secure retirement. This surprising emotional duality highlights a complex and evolving relationship between present-day financial pressures and future financial security. The disconnect between workers’ immediate economic realities and their long-term aspirations has never been more pronounced, raising critical questions about the psychological and structural factors that allow such conflicting sentiments to coexist and shape the financial landscape for millions. This phenomenon suggests that workers are increasingly adept at compartmentalizing their financial lives, viewing their current struggles as a temporary storm to weather on the path to a brighter, more stable future.

The Widening Chasm Between Aspiration and Reality

The benchmark for a comfortable retirement has shifted dramatically, with nearly half of all U.S. workers, or 48%, now believing they need at least $1 million saved, a significant jump from 37% just a year prior. This seven-figure goal has become the new standard for financial security in post-work life, reflecting anxieties over rising living costs and longer life expectancies. However, a stark and troubling disconnect exists between this lofty aspiration and the perceived reality. A recent analysis reveals that only 27% of those who set this goal believe they will realistically achieve it. This gap underscores a growing sense of financial inadequacy, where the target for a secure future feels increasingly unattainable for a large portion of the population. The psychological weight of this disparity contributes heavily to the overarching financial stress, as workers are constantly measuring their progress against a benchmark that seems to be moving further out of reach, creating a cycle of ambition followed by discouragement.

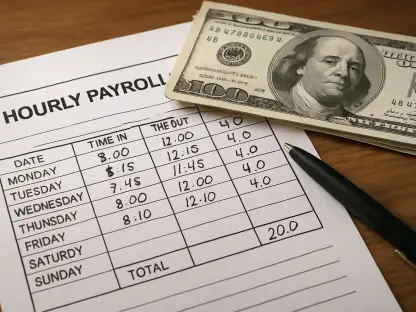

Compounding the anxiety surrounding long-term savings goals are the relentless pressures of the present day, which have pushed financial stress to an all-time high, affecting 90% of workers. This pervasive unease is not abstract; it is fueled by tangible economic challenges, including persistent inflation that erodes purchasing power, steadily rising credit card balances that signal a reliance on debt for daily expenses, and prohibitively high housing costs that consume a significant portion of income. These immediate financial burdens have a direct impact on future planning, forcing many to reevaluate their retirement timelines. In fact, more than half of the workforce, at 54%, has recently considered the necessity of working longer than originally planned. This trend indicates that for many, the dream of retirement is being deferred not by choice, but by the economic necessity of managing current financial obligations, further complicating the path to long-term security.

A Generational Divide in Financial Sentiment

An examination of financial sentiment across different age groups reveals deep demographic divides, with generational experiences profoundly shaping both anxiety and optimism. Gen Z, the youngest cohort in the workforce, surprisingly expresses the most confidence in their retirement prospects, with an overwhelming 88% feeling secure about their long-term future. This optimism persists even as they simultaneously report the highest levels of daily financial stress, suggesting a belief that their long career runway will allow them to overcome current hurdles. In stark contrast stands Gen X, who are the least confident, with only 61% expressing optimism about their retirement. This pessimism is rooted in their unique position, often referred to as the “sandwich generation.” They are frequently caught between competing financial pressures, such as paying down mortgages, managing their own lingering student debt, funding their children’s education, and providing care for aging parents. This confluence of responsibilities leaves them with fewer resources and less time to focus on their own retirement savings.

The key to understanding the sustained optimism, despite widespread anxiety and generational pressures, lies in the expanding role of employer-sponsored support systems. The availability and adoption of workplace financial wellness benefits have seen a significant upswing, providing a crucial safety net that buoys employee confidence. Participation in employer-sponsored retirement plans has climbed to a record 91%, driven by features like 401(k) plans with valuable matching contributions and the introduction of innovative emergency savings programs. These tools appear to be instrumental in helping employees compartmentalize their finances. They can acknowledge and manage their immediate financial stress while simultaneously trusting that the automated, structured nature of their workplace benefits is steadily building a foundation for a secure future. This structural support system allows them to separate present-day worries from long-term goals, effectively closing the psychological gap between their current financial reality and their retirement aspirations. Furthermore, these benefits are particularly crucial for demographics like women, who report higher financial instability and are more likely to consider delaying retirement.

A Reassessment of Financial Futures

The prevailing financial landscape revealed a workforce that had become adept at navigating a dual existence. On one hand, employees confronted immediate and tangible economic pressures that fueled daily anxiety. On the other, they held onto a steady, long-term optimism, a sentiment that was largely underwritten by the growing prevalence of robust employer-sponsored financial tools. This reliance on workplace benefits marked a significant evolution in how individuals approached retirement planning, shifting some of the psychological burden from the individual to a more structured, systematic savings process. The data suggested that the path forward was paved not just with individual discipline, but with the continued expansion and enhancement of these supportive systems, which proved essential in helping workers bridge the ever-present gap between their stressful present and their hopeful future.