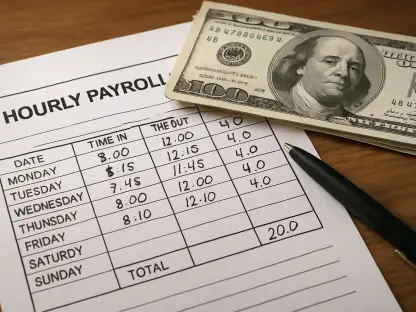

Imagine a single parent in a bustling city, juggling two jobs just to pay rent, yet still falling short when the grocery bill arrives, with each month bringing numbers that don’t add up as bills climb higher while the paycheck stays stubbornly flat. This scenario isn’t an outlier; it’s the harsh reality for millions of American workers grappling with a cost of living that surges ahead of wage growth. The frustration of shrinking budgets and unmet needs touches countless households, sparking a critical question: why does this gap persist, and what keeps earnings from matching the escalating demands of daily life? This exploration dives into the heart of an economic crisis that reshapes lives, uncovering the forces at play and the voices demanding change.

The Financial Crunch Hitting Home

For many, the monthly budget feels like a losing battle. Essentials like housing, food, and transportation consume larger chunks of income, leaving little for savings or unexpected expenses. A recent survey revealed a staggering 94% of workers pointing to groceries as their fastest-rising cost, a stark indicator of how basic needs strain finances. This relentless pressure transforms small decisions—whether to buy fresh produce or opt for cheaper, less nutritious options—into weighty trade-offs, highlighting a disconnect between earnings and expenses that grows more personal by the day.

The significance of this issue cannot be overstated. Beyond individual struggles, the wage-cost gap threatens broader economic stability, as families cut back on spending and delay major purchases, slowing recovery in key sectors. When workers can’t keep up, the ripple effects touch employers, communities, and policymakers alike, making this a national concern that demands attention. Understanding the root causes and consequences is the first step toward addressing a crisis that leaves too many behind.

Unpacking the Economic Divide

At the core of this struggle lies a troubling trend: the cost of living, driven by inflation, consistently outpaces wage increases. Essentials like gas and housing have seen dramatic price hikes over recent years, while average earnings for many remain stagnant or grow at a snail’s pace. Data shows that inflation has eroded purchasing power, meaning a dollar today buys far less than it did even a short time ago, leaving workers unable to afford the basics without dipping into savings or debt.

This imbalance isn’t just a statistic; it’s a lived experience for countless Americans. Families face tough choices, such as skipping medical care or postponing home repairs, as they prioritize immediate survival over long-term security. The broader economy feels the strain too, with reduced consumer spending impacting businesses and job growth. This persistent disparity sets the stage for deeper systemic issues that keep wages from aligning with the reality of modern expenses.

Forces Behind the Stagnant Paychecks

Several key factors contribute to the stubborn gap between wages and living costs. Corporate reluctance to raise pay, often prioritizing profit margins over employee compensation, plays a significant role in keeping earnings low. Additionally, the federal minimum wage has not been adjusted in over a decade, losing value against inflation and failing to provide a livable income for many in entry-level roles. Economic disruptions, such as temporary government shutdowns, further exacerbate the problem by halting critical support like SNAP benefits, forcing reliance on overstretched resources.

The consequences are dire and measurable. In Miami, food bank usage spiked by 1,800% during a recent federal shutdown, a vivid example of how quickly financial stability can crumble under added pressure. Workers face mounting debt, delayed life milestones like buying a home, and increased workplace burnout as they take on extra hours or second jobs just to make ends meet. These ripple effects reshape not only individual lives but also labor markets, as dissatisfaction drives turnover and reduces productivity.

Hearing from Those Affected

The human toll of this economic divide comes through in the voices of workers and experts alike. Julie Su, a senior fellow at a prominent policy institute, captures the sentiment with striking clarity, noting that employees feel “stressed, strained, and under attack” when paychecks can’t cover rent or other necessities. This emotional weight is backed by hard numbers: a survey of over 1,200 U.S. workers found 95% believe their wages haven’t kept pace with inflation, with only a tiny fraction receiving raises to offset rising costs.

Stories from the ground add depth to these findings. Consider a retail worker who, despite years of service, can’t afford childcare without cutting back on meals, a dilemma that mirrors countless others. Experts emphasize that this isn’t just about numbers on a paycheck—it’s about dignity and the ability to live without constant fear of financial collapse. These combined perspectives paint a picture of a workforce stretched thin, desperate for solutions that match the scale of their challenges.

Pathways to Close the Divide

Addressing this imbalance requires action on multiple fronts, from individual strategies to sweeping policy reforms. For workers, advocating for rights through unions or seeking roles in higher-paying industries can offer a lifeline, though such moves often come with barriers like retraining costs. Employers, meanwhile, hold power to improve retention and morale by offering fair compensation, flexible schedules, and support systems that acknowledge the real cost of living faced by their teams.

On a systemic level, policy recommendations provide a roadmap for change. Proposals include eliminating subminimum wages, enforcing pay transparency laws to combat disparities, and expanding training programs to equip workers for better opportunities. States can lead the charge by adopting these measures, holding corporations accountable where federal action lags. These steps, while not immediate fixes, lay the groundwork for an economy where earnings reflect the true demands of modern life, offering hope for a more balanced future.

Reflecting on Steps Taken and Roads Ahead

Looking back, the struggle of wages failing to match the rising cost of living painted a grim picture for American workers, as countless families wrestled with impossible budgets and deferred dreams. The stark data and personal accounts underscored a crisis that touched every corner of society, from urban centers to rural towns, leaving no one untouched by the weight of financial strain. Efforts to spotlight these challenges through surveys and expert analyses brought much-needed visibility to an issue too often ignored.

Yet, the path forward demands more than awareness—it calls for concrete action. Policymakers are urged to prioritize wage reforms and protective laws that can rebuild trust in economic fairness. Employers face pressure to rethink compensation models, recognizing that investing in their workforce is not just ethical but essential for long-term success. For workers, the encouragement is to keep pushing for change, whether through collective bargaining or skill-building, ensuring their voices shape the solutions of tomorrow.