I’m thrilled to sit down with Sofia Khaira, a renowned specialist in diversity, equity, and inclusion, who has dedicated her career to transforming talent management and development practices. As an HR expert, Sofia has been at the forefront of creating inclusive and equitable workplaces, and today, she’s here to share her insights on a groundbreaking strategic partnership in the HR tech space focused on financial wellness. This collaboration aims to revolutionize how employees access their earnings and how employers support their workforce’s financial health. We’ll dive into the goals of this initiative, its impact on workers and businesses, and the broader implications for employee well-being and engagement.

Can you walk us through the core purpose of this strategic partnership in the HR tech and financial wellness space?

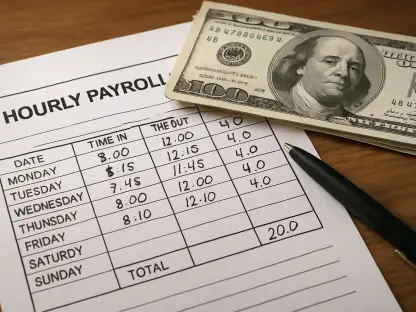

Absolutely, Alex. This partnership is centered on bringing on-demand pay to employees, allowing them to access their earned wages in real time, rather than waiting for a traditional payday. The main goal is to alleviate financial stress, especially for frontline and hourly workers who often face unexpected expenses. It’s about empowering employees with control over their finances while helping employers build a more engaged and loyal workforce. This initiative stands out because it integrates seamlessly into existing HR systems, making it a practical and scalable solution for businesses.

What unique strengths does the on-demand pay provider bring to this collaboration that made them the ideal partner?

The provider in this partnership offers a user-friendly platform that prioritizes accessibility and immediacy. Their technology allows for instant access to earned wages, which is a game-changer for workers living paycheck to paycheck. Additionally, their focus on integration with HR and payroll systems ensures a smooth experience for both employees and employers. Their commitment to financial wellness as a core mission really aligned with the broader goal of supporting total employee well-being, making them a standout choice for this collaboration.

How does real-time access to wages specifically benefit employees, particularly those in hourly or frontline roles?

For many hourly and frontline workers, financial stress is a constant burden due to unpredictable expenses like medical bills or car repairs. Real-time access to wages means they can tap into what they’ve already earned without waiting for payday or resorting to high-interest loans. It’s as simple as checking an app and transferring funds when needed. This flexibility can significantly reduce anxiety, improve job satisfaction, and help workers feel more valued and supported, which is crucial for their overall well-being.

What advantages does this partnership offer to employers who are looking to enhance their employee experience?

Employers gain a lot from offering on-demand pay. It’s a powerful tool for recruitment and retention, as it shows a commitment to employees’ financial health, which is a top concern for many workers today. It can also boost productivity and engagement since employees who aren’t stressed about money are more focused and motivated. While there might be some initial setup costs or learning curves, the long-term benefits—like reduced turnover and a stronger employer brand—far outweigh the challenges for most businesses.

Given that this on-demand pay solution has been integrated into HR systems for a while, what’s new or exciting about this deepened partnership?

Since the initial integration in 2023, this partnership has evolved to create an even more connected and seamless experience for users. The focus now is on enhancing the interface and functionality, so employees can access their earnings with just a few clicks, and employers have better tools to manage the system. Recent updates have prioritized user feedback, making the platform more intuitive. This deepened collaboration also means a broader reach, allowing more companies and workers to benefit from these innovations.

Financial health is often described as a critical component of employee well-being. Can you elaborate on why this matters so much in today’s workforce?

Financial health is foundational to an employee’s overall well-being because money worries can spill over into every aspect of life—mental health, family dynamics, and job performance. With so many workers living paycheck to paycheck, financial stress is a pervasive issue that can lead to burnout or disengagement. By giving employees control over when they get paid, employers help remove a major stressor, fostering a sense of security and trust. This, in turn, creates a more resilient and committed workforce, which is invaluable in today’s competitive labor market.

With over half of U.S. workers struggling to make ends meet between paychecks, how does this initiative aim to tackle that widespread issue?

This initiative directly addresses the paycheck-to-paycheck cycle by allowing workers to access their money as they earn it, rather than being tied to a rigid pay schedule. For someone in that situation, it can mean the difference between paying a bill on time or facing late fees and debt. Early feedback from users has been incredibly positive—many have shared how this flexibility has helped them avoid predatory loans or overdraft fees. It’s not just a financial tool; it’s a lifeline that restores dignity and control to workers facing tough circumstances.

There’s a perspective that this partnership is reshaping the dynamic between employers and employees. Can you explain what that means and why it’s significant?

This partnership redefines the employer-employee relationship by shifting the focus from a transactional exchange to a supportive partnership. Traditionally, pay schedules are set by the employer, leaving little room for employee needs. On-demand pay flips that script, putting workers in the driver’s seat and showing that employers care about their immediate financial challenges. This builds trust and loyalty, creating a culture where employees feel seen and valued. It’s a significant step toward a more human-centered approach to work, which is the future of HR.

What’s your forecast for the future of financial wellness solutions in the workplace?

I believe financial wellness solutions will become a standard expectation in the workplace over the next decade. As awareness grows about the impact of financial stress on productivity and mental health, more companies will adopt tools like on-demand pay to differentiate themselves in the talent market. We’ll likely see even deeper integrations with HR technologies, personalized financial education, and maybe even AI-driven insights to help employees manage their money better. The focus will continue to shift toward holistic employee well-being, with financial health at the core of that movement.