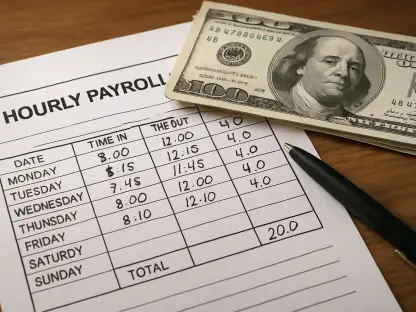

Michigan is set to implement a new tipped-wage law next month, which will significantly impact local restaurants and their employees. The law will raise the current tipped wage from $3.93 an hour to $5.99 an hour on February 21, 2023, with a gradual increase peaking at $11.98 an hour in subsequent years. Additionally, Michigan’s minimum wage will also increase, rising to $12.48 an hour next month and reaching $14.97 an hour by 2028. This law also introduces changes to sick leave, allowing most employees to accumulate paid sick leave at a rate of one hour for every 30 hours worked.

Financial Repercussions for Businesses

Increased Operational Costs

Business owners, like John Benson of JJ’s Steak and Pizza House and Arturo Mendez of Mango’s Tequila Bar, express concerns that the wage increase will raise operational costs. They fear that to cover these costs, they will need to elevate prices, which could lead to decreased patronage as customers might dine out less frequently due to higher costs. John Benson, reflecting on his experience, shared his worries about balancing fair wages with the financial health of his restaurant, suggesting that higher wages might force him to cut staff hours or even make layoffs.

Arturo Mendez echoed similar concerns, noting that small businesses like his are often on tight margins. The prospect of further financial strain due to the wage law is daunting. Many restaurant owners foresee a challenging period ahead, as they will need to navigate between staying profitable and adhering to new regulations. There is a consensus that while the intention of the law is noble, its implementation might present hurdles that could strain already fragile small business ecosystems.

Potential Decrease in Customer Patronage

The anticipated rise in prices could deter customers from dining out as often, leading to a potential decrease in overall sales. This reduction in customer traffic could further strain the financial viability of small businesses, making it challenging to sustain operations without compromising on service quality or staff employment. Various business owners have voiced apprehensions about this potential trend, highlighting the delicate balance between pricing and customer loyalty that is critical for their survival.

Many restaurateurs fear that with increased operational costs and raised menu prices, the frequency of customer visits may drop. As dining out becomes more expensive, customers might opt for more cost-effective alternatives, affecting overall sales and revenue. This anticipated shift in consumer behavior could have a domino effect on the local economy, further emphasizing the need for careful consideration and possible amendments to the wage law to alleviate these concerns.

Impact on Tipped Employees

Concerns Over Reduced Tipping

For tipped employees, such as waitress Zoe Boyle and veteran bartender Traci Boyle, there is anxiety that increased wages will lead to reduced tipping. They worry that customers might feel less inclined to tip generously if they know that the base wage has increased, consequently impacting their overall earnings. Zoe Boyle shares her experience, mentioning how dependent she is on tips to cover her living expenses, and expressing concern over how changing tipping behaviors might affect her financial stability.

Traci Boyle underscores that tips form a substantial part of her income, often making up the difference between a manageable month and a financially strained one. The fear that customers will tip less generously poses a significant threat to tipped employees, who rely on extra gratuities to make ends meet. The apprehensions about reduced tipping are not unfounded, given that similar wage increases in other areas have led to altered tipping behaviors among patrons.

Balancing Fair Wages and Earnings

The new law aims to ensure fair wages for employees, but there is a fear that it might inadvertently reduce their total income. Tipped employees rely heavily on tips to cover their basic expenses, and any reduction in tipping behavior could significantly affect their financial stability. This conundrum brings to light the complex dynamics within the tipped service industry, where raising base wages does not necessarily equate to higher overall earnings for employees.

Zoe and Traci are examples of individuals who might face unintended consequences of the law, embodying a larger group of workers whose financial well-being is closely tied to customer generosity. While the legislative intent is to uplift employees, there needs to be a nuanced understanding of how these changes might play out in real-world scenarios, possibly warranting legislative adjustments to retain the tipping culture while ensuring fair wages.

Legislative Actions and Amendments

State Legislators’ Response

Many stakeholders, including state legislators, acknowledge the potential fallout from the new wage laws. Politicians like State Rep. Cam Cavitt and State Sen. Michelle Hoitenga have shown a willingness to support changes to protect both the employees and the small business owners. They are actively seeking amendments to the law to mitigate these challenges. These efforts signify a proactive approach to creating a balanced framework that serves the interests of both workers and employers.

Cam Cavitt and Michelle Hoitenga’s engagement highlights that policymakers are not oblivious to the intricacies and potential unintended consequences of the wage law. Their advocacy for amendments reflects an understanding that legislative measures must adapt to the ground realities faced by the business community and the workforce. This ongoing dialogue between legislators and stakeholders is crucial for ensuring that the wage law’s implementation is fair and sustainable.

Potential Adjustments to the Law

Legislative efforts are focused on finding a balanced resolution that ensures fair wages for employees while maintaining the financial viability of small businesses. These adjustments could include phased implementation or additional support measures for businesses to ease the transition. State legislators are considering various approaches to fine-tune the law, such as tax breaks or subsidies for small businesses to offset increased payroll costs.

One possible adjustment being discussed is the phased rollout of wage increases, which would give businesses more time to adapt. Another suggestion includes providing financial incentives for employers who adhere to the new laws without reducing their workforce. These potential amendments aim to cushion the transition period for businesses and ensure that the law achieves its goal of fair employee compensation without causing undue economic strain.

Broader Economic Implications

Ripple Effect on Local Economy

Arturo Mendez, owner of Mango’s Tequila Bar, points out the potential ripple effect of fewer customers translating to a reduced need for staff. This could influence the local unemployment rate, as businesses might reduce staff hours or even lay off employees to cope with the increased wage costs. Mendez’s assessment suggests a broader economic impact wherein changes within one business sector could have cascading effects throughout the local economy.

Such ripple effects could exacerbate issues of unemployment and underemployment, particularly in regions where the service industry forms a significant part of the local economic fabric. The cumulative impact of reduced staff hours and potential layoffs might not only affect the immediate business environment but also strain community resources and social services, highlighting the complex interdependencies within local economies.

Preemptive Measures by Business Owners

Some business owners, like John Benson, are already taking preemptive steps to ease the transition. By providing raises to staff ahead of the law’s implementation, they hope to mitigate the immediate impact and maintain employee morale. However, there is still a pervasive sense of uncertainty about the long-term effects. Benson’s proactive approach reflects a broader trend among business owners who recognize the inevitability of change and are seeking ways to adapt while protecting their workforce.

Despite such efforts, uncertainty looms large, and the long-term sustainability of these measures remains questionable. Business owners find themselves in uncharted territory, evaluating different strategies to balance compliance with financial viability. The adaptability and resilience of these businesses will be put to the test as they navigate the evolving regulatory landscape.

Current Conditions in the Service Industry

Reliance on Tips

The article explores the current conditions in the service industry, emphasizing the reliance of waitstaff and bartenders on tips to cover their basic expenses. Traci Boyle’s point about the demanding nature of her job highlights the stress and labor intensity that such employees endure, often justifying the current tipping model. Her insights emphasize the grueling work conditions that tipped employees face, highlighting the importance of tips in bridging the gap between their base pay and actual living expenses.

Boyle’s perspective sheds light on the broader workforce within the service industry, where employees often go above and beyond their job descriptions to ensure customer satisfaction. The reliance on tips is not just a matter of tradition but a critical component of their financial structure. Understanding this reliance is essential for shaping policies that genuinely support the well-being of service industry workers.

Importance of Tips for Earnings

Tips play a crucial role in making the earnings of service industry employees commensurate with the hard work and long hours involved in their roles. Any changes to the tipping model or customer behavior could significantly impact their financial well-being. The intricacies of the service industry wage dynamics underscore the need for a balanced approach that recognizes the value of tips while ensuring fair base pay.

Boyle’s apprehensions resonate with many within the industry, advocating for a tipping system that complements fair wages instead of replacing them. Policymakers and stakeholders must engage in meaningful dialogue to protect the interests of these workers while fostering a sustainable business environment. The ongoing discussions reflect a willingness to understand and address the unique challenges faced by the service industry’s workforce.

Conclusion

Michigan is set to enforce a new law regarding tipped wages next month, which will significantly affect local restaurants and their employees. Starting on February 21, 2023, the current tipped wage will rise from $3.93 per hour to $5.99 per hour. This is just the beginning of a gradual increase that will ultimately reach $11.98 per hour in the coming years. In addition to changes in tipped wages, Michigan’s minimum wage will also see an increase. Next month, it will go up to $12.48 per hour, gradually ascending to $14.97 per hour by 2028.

Moreover, the law introduces important revisions to sick leave policies. Most employees will now be able to accumulate paid sick leave at a rate of one hour for every 30 hours worked. These changes are poised to have a significant impact on the local economy and the livelihoods of workers in the hospitality industry, giving them higher wages and better benefits over time. Business owners and employees alike will need to adapt to these new regulations as they come into effect.