I’m thrilled to sit down with Sofia Khaira, a renowned specialist in diversity, equity, and inclusion, who brings a unique perspective to the world of employee benefits. With her extensive experience in HR and talent management, Sofia has also developed a deep understanding of workplace pension schemes and their critical role in fostering employee well-being. Today, we’ll dive into the latest trends and challenges surrounding pension plans, exploring how often employers review their offerings, the impact of new regulations, and the importance of governance and professional guidance in ensuring these plans deliver real value.

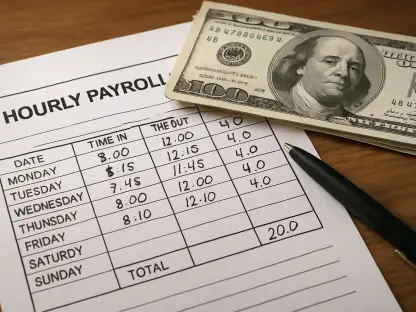

Can you share some insights on the recent findings about how often employers are reviewing their workplace pension plans?

Absolutely. Recent research shows that less than half of employers have reviewed their workplace pension schemes in the past 12 months to ensure they’re delivering value in terms of costs, investments, and services. What’s even more striking is that 10% of employers admit they’ve never reviewed their plans at all. I think this reflects a broader issue of pensions often being seen as a “set it and forget it” benefit, rather than a dynamic tool that needs regular attention to align with both employee needs and regulatory changes.

Why do you think so many employers haven’t prioritized reviewing their pension plans in the last year?

There are a few reasons for this. For many, pensions might not seem like an urgent priority compared to day-to-day operational challenges or other benefits like health insurance that get more visibility. There’s also a lack of awareness about how much a pension plan can impact employee satisfaction and retention. Additionally, some employers may not have the internal expertise or resources to conduct a thorough review, so they delay it or avoid it altogether.

What are the potential downsides for employers who haven’t taken a close look at their pension plans recently?

The risks are significant. First, an outdated or underperforming pension plan can erode employees’ trust and financial security, which directly affects morale and loyalty. Employers might also be missing out on cost efficiencies or better investment options that could benefit both the company and its workforce. Beyond that, there’s a reputational risk—if employees feel their retirement needs aren’t being prioritized, it can hurt the company’s ability to attract and retain talent.

How could neglecting pension reviews impact employees’ long-term financial well-being?

It’s a huge concern. If a pension plan hasn’t been reviewed, it might have high fees, poor investment performance, or lack the right support for employees nearing retirement. This can mean employees aren’t building the nest egg they expect, leaving them financially vulnerable later in life. Over time, this gap can widen, especially if employees aren’t engaged or educated about their options within the plan.

Can you walk us through the new Value for Money regulations being proposed for workplace pensions in the UK?

Of course. The UK government and regulators are introducing a framework to ensure workplace pensions deliver real value across cost, performance, and service. It’s a unified approach to hold schemes accountable. A key feature is the “red-amber-green” rating system, which will evaluate the performance of default investment options. These ratings will be publicly disclosed to push underperforming providers to improve, consolidate, or exit the market. It’s all about transparency and driving better outcomes for savers.

How do you see the public disclosure of these ratings influencing pension providers?

I think it’s going to be a game-changer. Public disclosure creates a competitive pressure that hasn’t existed before. Providers rated poorly—say, in the “red” category—will face scrutiny from employers and employees alike, which could lead to loss of business if they don’t step up. It incentivizes innovation and improvement, ensuring that providers focus on delivering value rather than just maintaining the status quo.

With these regulations expected to roll out in 2026 or 2027, do you think employers are ready for the changes?

Honestly, I don’t think most are. The timeline—with the first data publication set for 2028—might seem far off, but preparing for these changes takes time. Many employers are already behind on basic reviews, so adapting to a more rigorous framework will be a challenge. There’s a real need for education and proactive planning to ensure they’re not caught off guard when the regulations take effect.

Why is having a pension governance structure, like a committee or external advisor, so critical for employers?

A governance structure provides oversight and accountability, which is essential for managing something as complex as a pension scheme. Only about 52% of companies currently have this in place, which is concerning. A dedicated committee or advisor ensures that the plan is regularly reviewed, stays compliant with laws, and aligns with the company’s goals and employee needs. Without it, decisions can become reactive or inconsistent, leading to missed opportunities or costly mistakes.

What should employers focus on when evaluating whether their pension plan truly offers value for money?

It’s about looking at the whole picture. Fees and charges are a big piece—high costs can eat into employees’ savings over time. But employers also need to consider investment performance, the quality of default options, and whether the plan meets regulatory standards. Beyond numbers, employee engagement is key. Are workers actually participating? Do they understand their benefits? Support for retirement planning, like tools or counseling, can also make a huge difference in the plan’s overall value.

Why would you encourage employers to partner with a pension professional instead of managing these reviews themselves?

Pension schemes are incredibly intricate, with layers of regulation, investment strategy, and employee needs to balance. A professional brings specialized expertise to analyze costs, ensure compliance, and tailor the plan to the organization. They can also spot issues or opportunities—like optimizing salary sacrifice arrangements or boosting member education—that an internal team might overlook. Ultimately, their guidance saves time, reduces risk, and maximizes the plan’s impact.

What’s your forecast for the future of workplace pensions as these new regulations and expectations take shape?

I see a positive shift on the horizon. With the new Value for Money framework and increased transparency, I expect workplace pensions to become a more central part of how companies attract and retain talent. Employers will likely face growing pressure to not just offer a pension, but to ensure it’s competitive and well-managed. Over the next few years, I predict we’ll see more collaboration with professionals, stronger governance structures, and a renewed focus on employee education to make pensions a true cornerstone of financial wellness in the workplace.