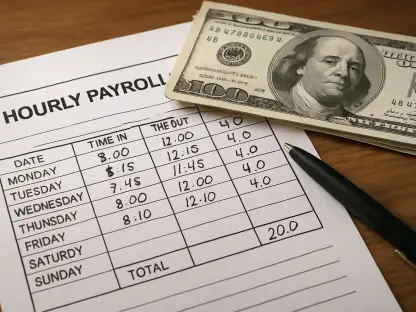

“Protect Your Workforce: Funding Wages After Disaster” delves into the essential issue of sustaining employee wages during unexpected disasters. Ensuring a well-supported workforce is crucial for business continuity and growth, especially during crises. Timely payment of wages significantly impacts employee morale and mental well-being. However, disasters like natural calamities, diseases, flooding, and property damage can disrupt business operations and payroll systems, posing challenges to consistent wage payments.

The article details payroll disasters as unforeseen events affecting employee payments, ranging from natural disasters to payroll errors. It highlights strategies to mitigate these challenges. Key methods include maintaining business health, assessing incident severity, and estimating recovery times to manage finances accordingly.

Critical strategies to ensure wage continuity post-disaster include:

Catastrophe Credit Insurance: This insurance covers businesses from financial losses due to unforeseen catastrophes, ensuring stability.

Employee Assistance Programs (EAPs): Investments in EAPs can support employees with counseling and financial guidance through financial difficulties post-disaster.

Disaster Relief Funds: Setting up these funds provides immediate and long-term financial assistance, maintaining wage payments during emergencies.

Vendor Partnerships: Collaborating with vendors can mobilize necessary funds and support affected employees.

Donations: Engaging customers through platforms like GoFundMe to raise funds for resuming business operations.

Ultimately, maintaining employee well-being through consistent wage payments is vital for business resilience and success. Businesses need proactive planning and comprehensive strategies, including insurance, support programs, and community support, to manage payroll continuity effectively. This multifaceted approach is crucial for upholding employee trust, ensuring operational stability, and maintaining business health amidst crises.